How Retailers Can Capitalize on the Current Landscape & Choose the Right Carrier Partner to Build a Competitive Advantage

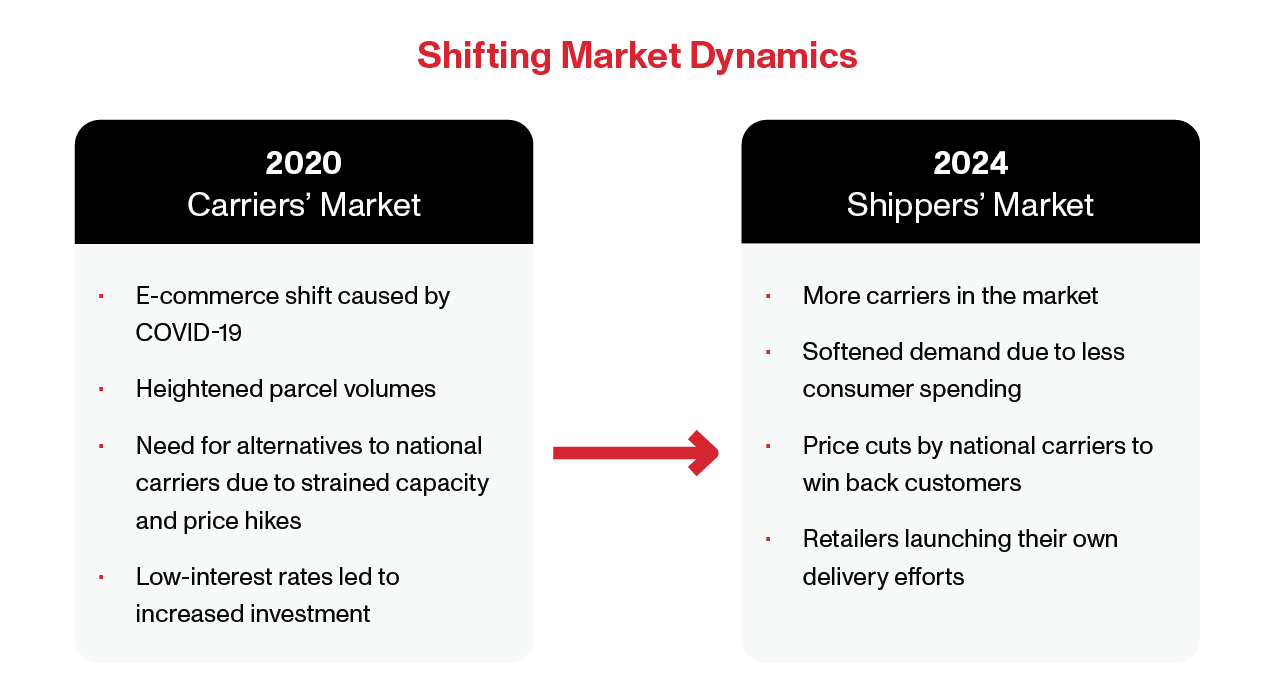

When COVID-19 sparked the shift from in-store to online shopping, retailers had to revamp their supply chains overnight. The pandemic quickly exposed the problems with single-carrier strategies, driving retailers to diversify their carrier bases and add alternative carriers to accommodate heightened volume and offset the seemingly endless surcharges, rate increases, and capacity constraints implemented by national carriers.

The last-mile landscape and market conditions have evolved since the pandemic began. Since then, more carriers have entered the market, demand has not kept up with supply, and national carriers are offering aggressive price discounts to win back volume.

So what’s next for carrier diversification?

The way retailers should approach diversifying their carrier bases today is not the same as it was three years ago. Not all carriers are created equal.

In this guide, we’ll explore why shippers are using multi-carrier strategies, the current dynamics between shippers and carriers, how retailers can choose the right carrier partner, and what the future looks like for carrier diversity.

The Rise of Carrier Diversity & Benefits of Multi-Carrier Strategies

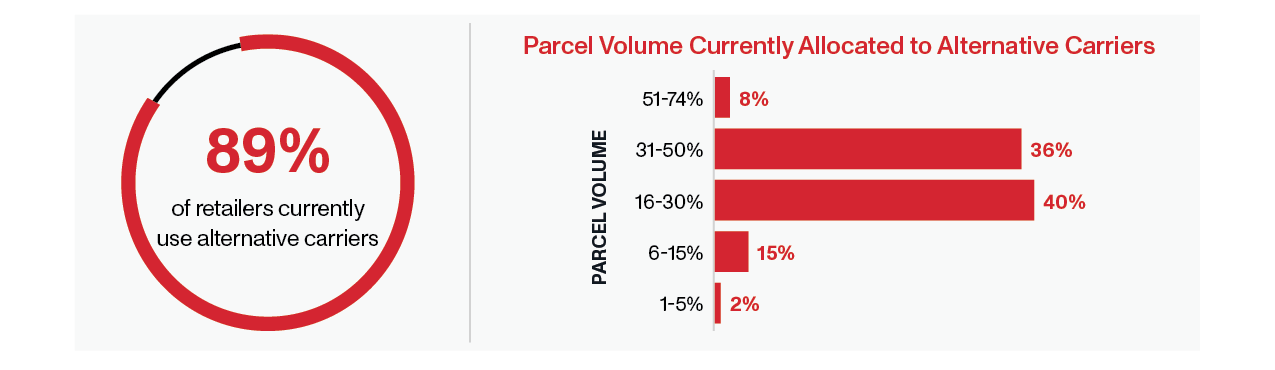

Carrier diversification is no longer a trend but has become a fundamental part of a successful supply chain strategy. Retailers have experienced the positive impacts of using alternative carriers and continue to leverage them today. OnTrac surveyed over 150 supply chain executives from leading omnichannel retailers and found that 89% are currently relying on alternative carriers, with three-quarters (76%) of those sending 16-50% of their total volume to alternative carriers.

Why are retailers diversifying their carrier bases? Relying solely on one parcel carrier subjects shippers to a multitude of risks, including rising costs, limited flexibility, and delivery delays and supply chain disruptions that compromise the customer experience. Compared to national carriers, alternative carriers provide faster delivery times, lower costs, greater flexibility, and personalized support.

Sixty percent of retailers chose to use alternative carriers due to faster delivery, with another 36% indicating they were influenced by cost savings. Retailers also cited quality of delivery experience, on-time performance, and geographic coverage as driving factors.

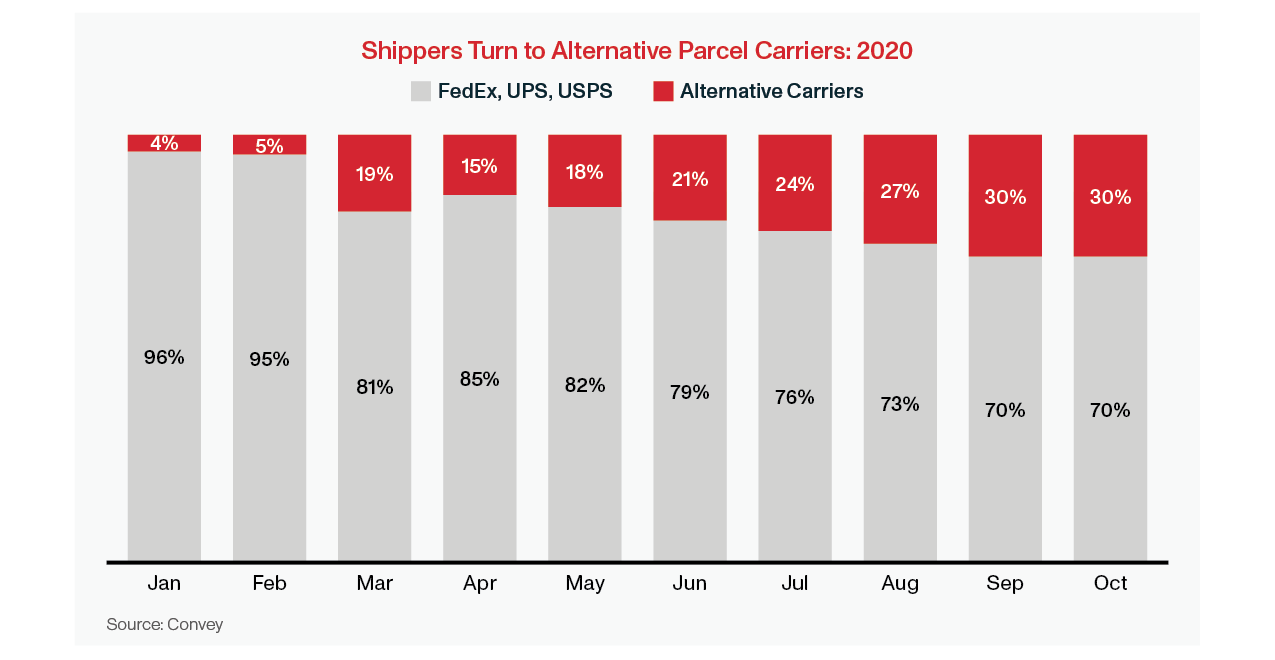

The use of multi-carrier strategies is expected to keep pace moving forward, with more than half (53%) of retailers planning to utilize alternative carriers over the next year. This data makes a compelling case for the staying power of alternative carriers, which were responsible for only 4% of parcel deliveries in January 2020.

Current Shipper-Carrier Dynamics: Shippers Finally Have the Upper Hand

In a reversal from the last three years, retailers and shippers finally have the upper hand. Shippers are using the increasingly competitive landscape and soft demand environment to their advantage to negotiate discounts and concessions.

Shippers today have more parcel carrier options than ever.

More mature regional carriers have expanded and improved how they help shippers reach their customers, gig-economy carriers have emerged and carved out a niche in the marketplace, and USPS has become a more competitive option. With so many options available, a sophisticated shipper that cannot get what they want from Carrier A can likely negotiate and get it from Carrier B.

Along with increased competition, soft demand is helping to drive down shipping costs. In 2021 and 2022, carriers raised prices tremendously and shippers largely paid them out of necessity. Retailers in 2024 have far more leverage and are winning discounts from UPS and FedEx for the first time in four years, as the duopoly fights to win back business and market share amid soft market conditions. UPS is also fighting to win back volume lost amid concerns over the potential strike, during which time shippers diverted roughly 1 million parcels daily to other carriers.

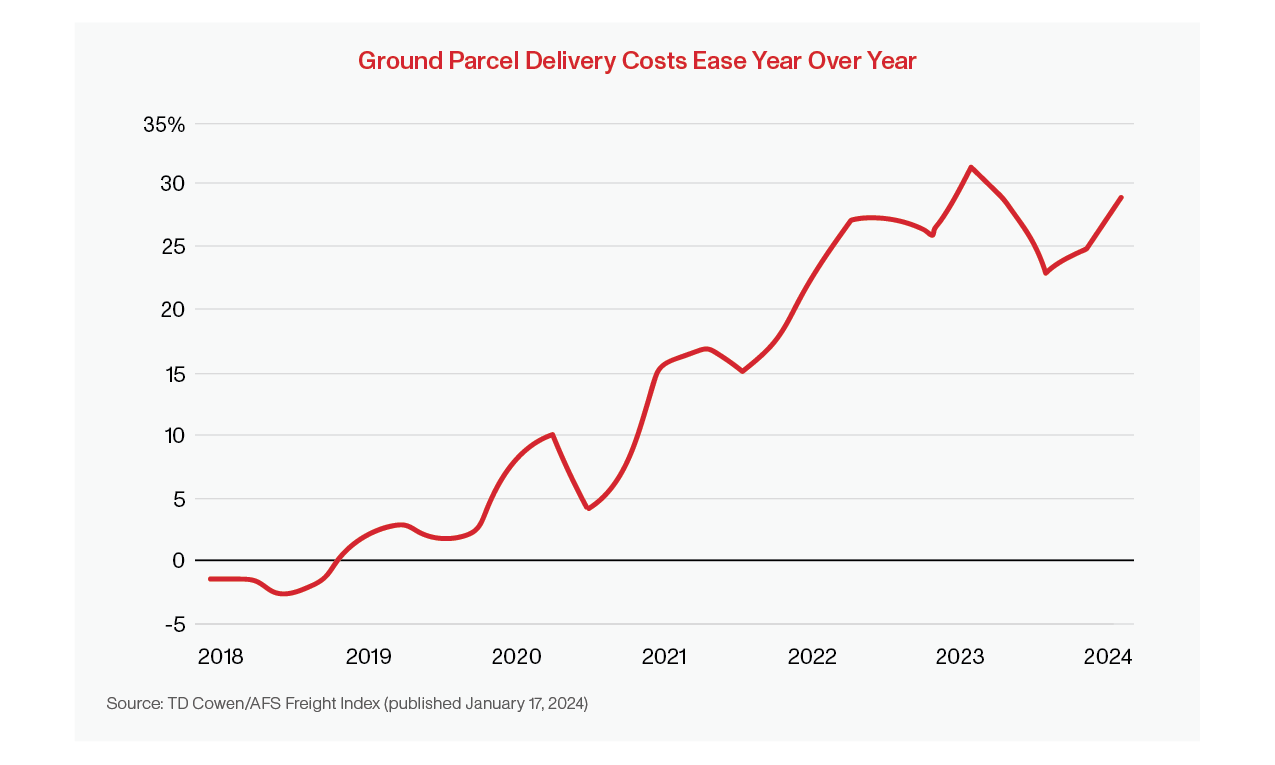

Shippers are now seeing prices fall as a result of the current landscape. Ground parcel rates experienced their first year-over-year decline since 2019 in the third quarter of 2023. The ground parcel rate per package in Q3 was 23.2% above the January 2018 baseline, down from 26.9% the year prior. Larger pricing discounts, along with reductions in added fees and fuel surcharges, helped drive the index down. As for 2024, shipping discounts from UPS and FedEx are poised to soften the impact of their rate hikes on ground delivery customers, according to the latest TD Cowen/AFS Freight Index released January 17. The ground parcel rate per package is projected to reach 28.9% above the index’s January 2018 baseline in Q1, a decline from 31% the previous year.

Problems with Over-Diversification

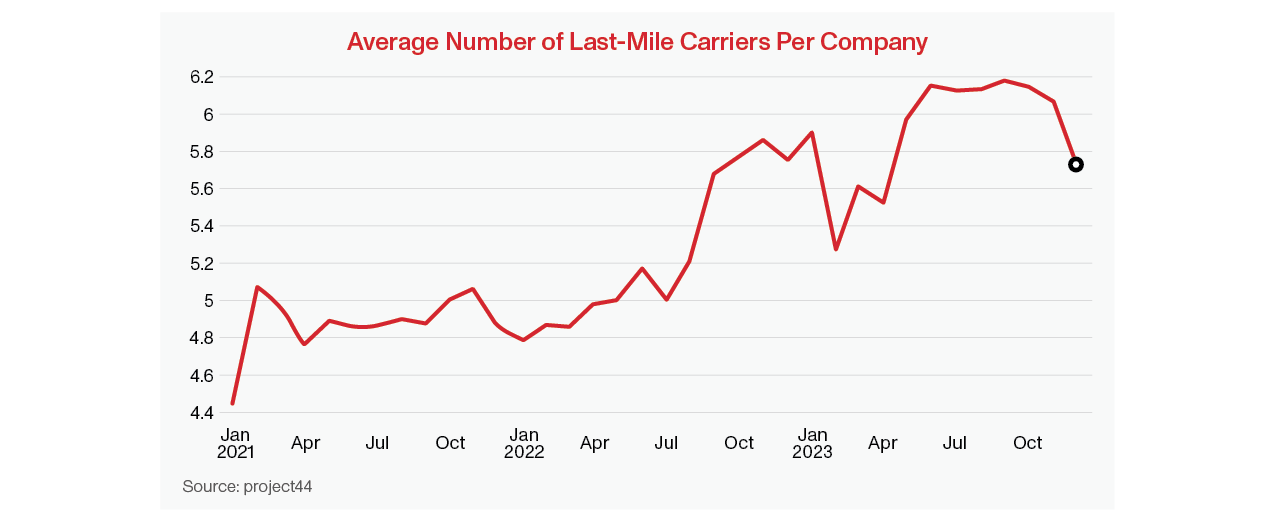

While carrier diversity is fundamental to a successful supply chain strategy, the emerging trend of over-diversification puts retailers at a disadvantage. During the pandemic, carrier diversification became a necessity for retailers, as it became clear that a single-source logistics solution was no longer a viable supply chain strategy. Shippers could look to the many different regional carriers that could provide faster delivery than UPS and FedEx, increased capacity, and lower shipping rates. However, conditions have changed over the last year and a number of retailers have over-diversified. According to project44, retailers on average used a record high of 6.17 last-mile delivery carriers in June 2023.

Retailers that have failed to consolidate their carrier mixes are now losing out on opportunities for faster delivery and better pricing. Over-diversification is also causing constraints within the warehouse from sortation capability to available doors for carrier pickup.

What’s Next: The Great Carrier Consolidation

Carrier consolidation is already happening. Continued economic uncertainty has led to lower retail sales and e-commerce volumes, and in turn, forced retailers to go back to the table and look at overdiversification as a problem. Shippers should now be looking at a two to three carrier solution, rather than five or more options.

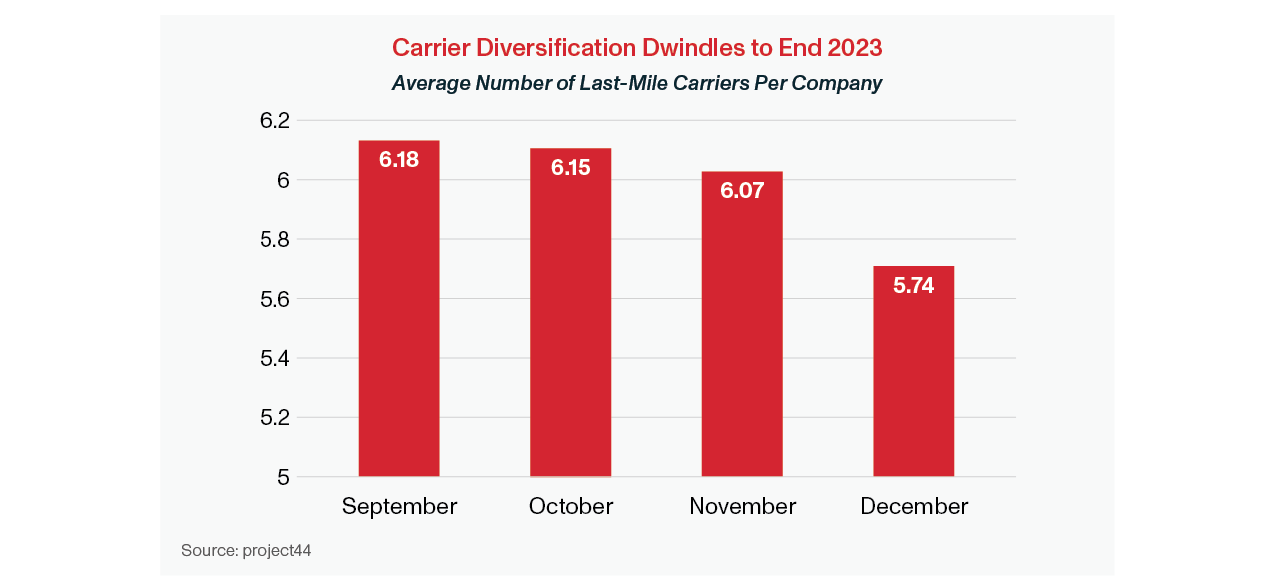

Carrier diversification dipped at the start of 2023, with many newer providers leaving the market. The number of carriers shippers relied on then spiked in June and July, as shippers prepared to mitigate supply chain disruptions from a potential UPS strike. Now that strike concerns have been alleviated, diversification is slowing down. The number of carriers per company declined for three straight months at the end of 2023, dropping to 5.74 in December.

Retailers on average are dropping around one carrier per month—and this theme is expected to continue. Capacity is no longer a concern due to softened delivery demand, and there is simply not enough volume to split up among multiple different carriers. UPS and FedEx are also offering aggressive shipping discounts to counteract volume declines, which may lead shippers to find it more difficult to justify dividing shipments among a wide range of carriers in an uncertain demand environment.

How to Choose the Right Carrier

Diversification today is a matter of quality over quantity. Not all carriers are created equal, and retailers need to be strategic when choosing a partner.

How can shippers choose the right carrier partner in a saturated market where supply exceeds demand? When evaluating potential carriers, it is imperative that shippers determine their goals, analyze the data, and prioritize service and partnership. Retailers should choose a proven alternative carrier that can provide the best combination of the following factors:

- Speed: In today’s instant gratification economy, consumers are increasingly choosing retailers that provide faster delivery. Retailers should choose a carrier that can meet consumers’ growing demands for faster delivery in order to remain competitive.

- Cost Savings: Retailers should look for a carrier that can offer the most cost-effective options to help them reach their customers.

- Service: Cost is important but shouldn’t be the only consideration. Retailers should carefully examine the service offerings and have conversations to understand if a potential partner’s solution fits their needs. A strong on-time performance record is critical, as well as an innovative tracking experience to make sure customers are satisfied.

- Network Coverage: A carrier that can provide the greatest amount of geographic coverage will prevent retailers from having to onboard multiple carriers to reach their customers in different locations.

- Delivery Innovation: Carriers that are investing in their networks and technology to improve the consumer experience should be a key focus for shippers.

- Experience: A reliable, proven carrier with experience, expertise, and infrastructure can help retailers keep up with the evolving e-commerce delivery landscape.

As e-commerce grows and brand loyalty declines, retailers that diversify their carrier bases by moving away from the two national providers and partnering with a proven alternative can differentiate themselves from the competition. Shippers should be intentional in choosing a long-term partner that meets their needs and can help them reach their goals. The right carriers will be transparent, flexible, and long-term partners who are committed to a shipper’s success.

About the Author

An industry veteran with over 20 years of experience, Josh Dinneen is the Chief Commercial Officer at OnTrac, the carrier of choice for last-mile, e-commerce parcel delivery, where he oversees revenue strategy, sales, marketing, account management, and call center operations. Josh has spearheaded the company’s transcontinental delivery service launch, which provides faster, cost-effective, coast-to-coast delivery to leading shippers and retailers. Prior to his current role, Josh created LaserShip’s e-commerce hub and spoke delivery network as the Vice President of Supply Chain.

About OnTrac

OnTrac is the parcel carrier of choice for last-mile e-commerce deliveries that helps retailers and shippers build a competitive advantage through faster delivery times, lower costs, coast-to-coast coverage, and reliable on-time performance. The OnTrac delivery network reaches approximately 85% of the U.S. population in 35 states and Washington, D.C. and enhances retailers’ ability to meet growing demand in the consumer e-commerce delivery market. With more than 65 years of experience, OnTrac has evolved into a critical part of the e-commerce infrastructure and is trusted by leading retailers and shippers that desire reduced transit times and increased flexibility within their supply chains.