The COVID-19 pandemic accelerated the shift to e-commerce by roughly five years. The impacts spread quickly across the e-commerce industry, creating new growth opportunities while also exposing a number of supply chain vulnerabilities.

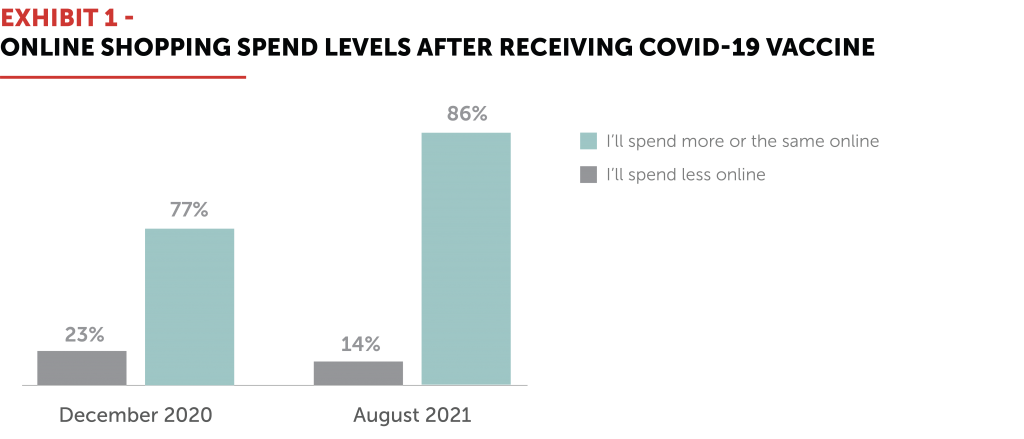

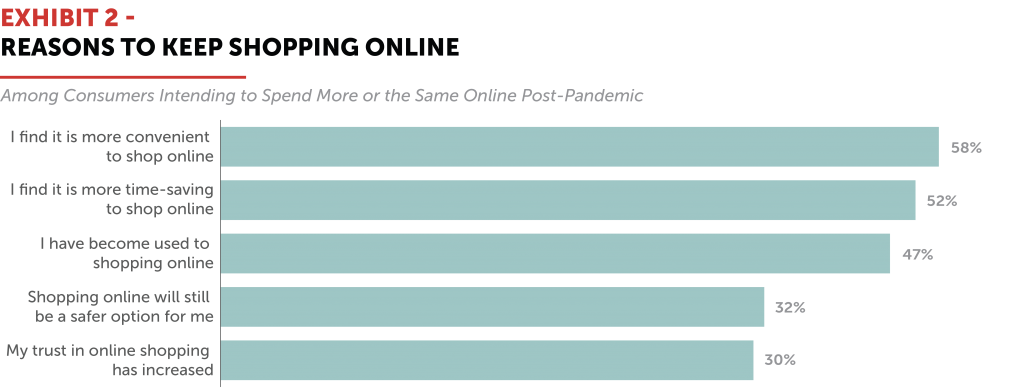

While the pandemic may have changed the way consumers shop, these new behaviors are not going away anytime soon. Exhibit 1 shows that 86% of consumers are planning to maintain or increase their level of online shopping after COVID-19. Exhibit 2 outlines the reasons why, citing convenience and time-savings as the primary motivations. As more consumers shop online, how retailers handle their delivery strategy or post-purchase shopping experience can make or break their business.

Retailers have a tremendous opportunity to capitalize on the growing e-commerce market and establish lasting relationships with consumers. LaserShip Partnered with Hanover Research to survey more than 3,000 consumers over the last two years to understand how their shopping behaviors and preferences have evolved since the start of the pandemic. The results indicate that consumers overwhelmingly prefer home delivery, slow delivery drives consumers to shop elsewhere, consumers are willing to pay for faster delivery, and free shipping remains the most important factor when shopping online.

In this whitepaper, we will explore the key takeaways and offer recommendations to help retailers adapt their supply chains to gain a competitive advantage and meet evolving consumer expectations.

Key Takeaways

-

Consumers still overwhelmingly prefer home delivery

-

Slow delivery times lead consumers to shop elsewhere

-

Consumers are willing to pay for fast delivery

-

Free shipping still reigns supreme

Consumers Still Overwhelmingly Prefer Home Delivery

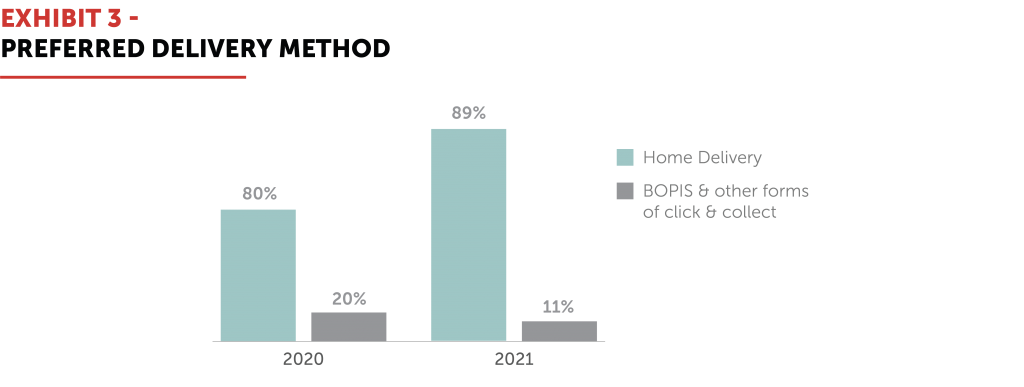

As convenience increasingly drives online purchasing decisions, it is no surprise that more consumers are looking for fast and reliable home delivery. The demand for home delivery is at an all-time high and it is only growing stronger. Exhibit 3 shows that 89% of consumers surveyed prefer home delivery over BOPIS and other forms of click and collect, up nearly 10% from 2020, even with the vaccine available and in-store shopping restrictions lifted in many states at the time of this survey August 2021.

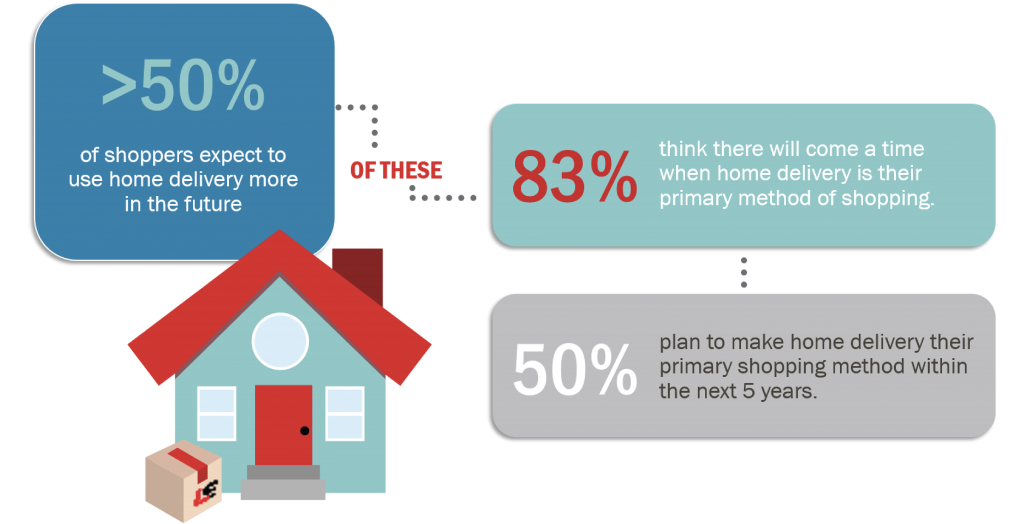

New shopping behaviors caused by the pandemic are here to stay—and in the case of home delivery, are expected to grow further. According to a study by SWNS Digital, over 50% of shoppers expect to use home delivery more in the future. Of these, 83% think there will come a time when home delivery is their primary method of shopping, and half plan to make home delivery their primary shopping method within the next five years.

Slow Delivery Times Lead Consumers to Shop Elsewhere

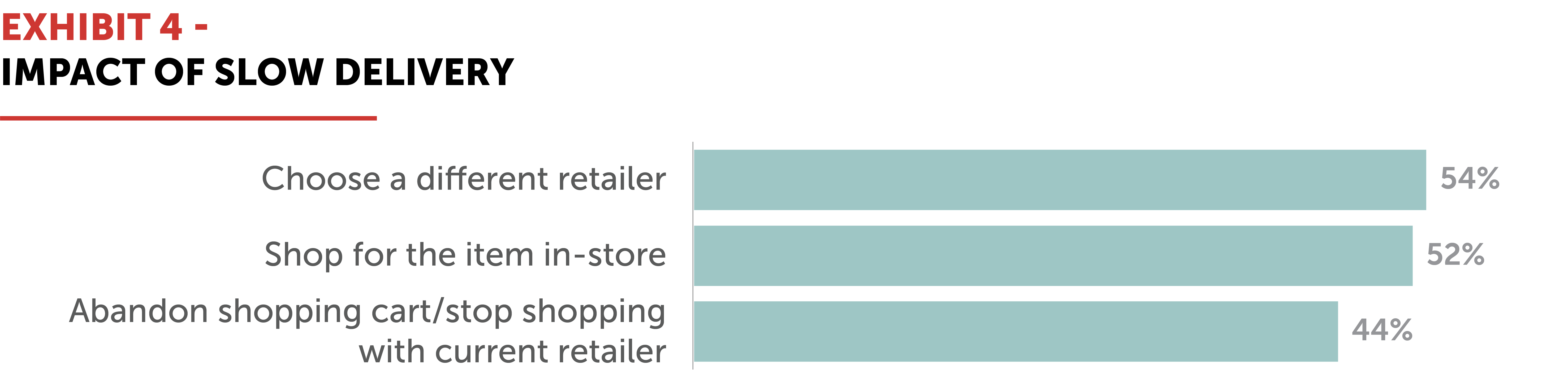

Customers no longer see fast delivery as a perk—they view it as a requirement. Slow delivery times are costing retailers business. According to Convey, nearly 50% of shoppers will abandon their carts if delivery timelines fail to meet their expectations3. In 2021 alone, 64% of consumers reported that slow delivery times prevented them from trying a new retailer or caused them to shop elsewhere. Slow delivery also causes consumers to choose a different retailer (54%) or shop for an item in-store (52%), as shown in Exhibit 4.

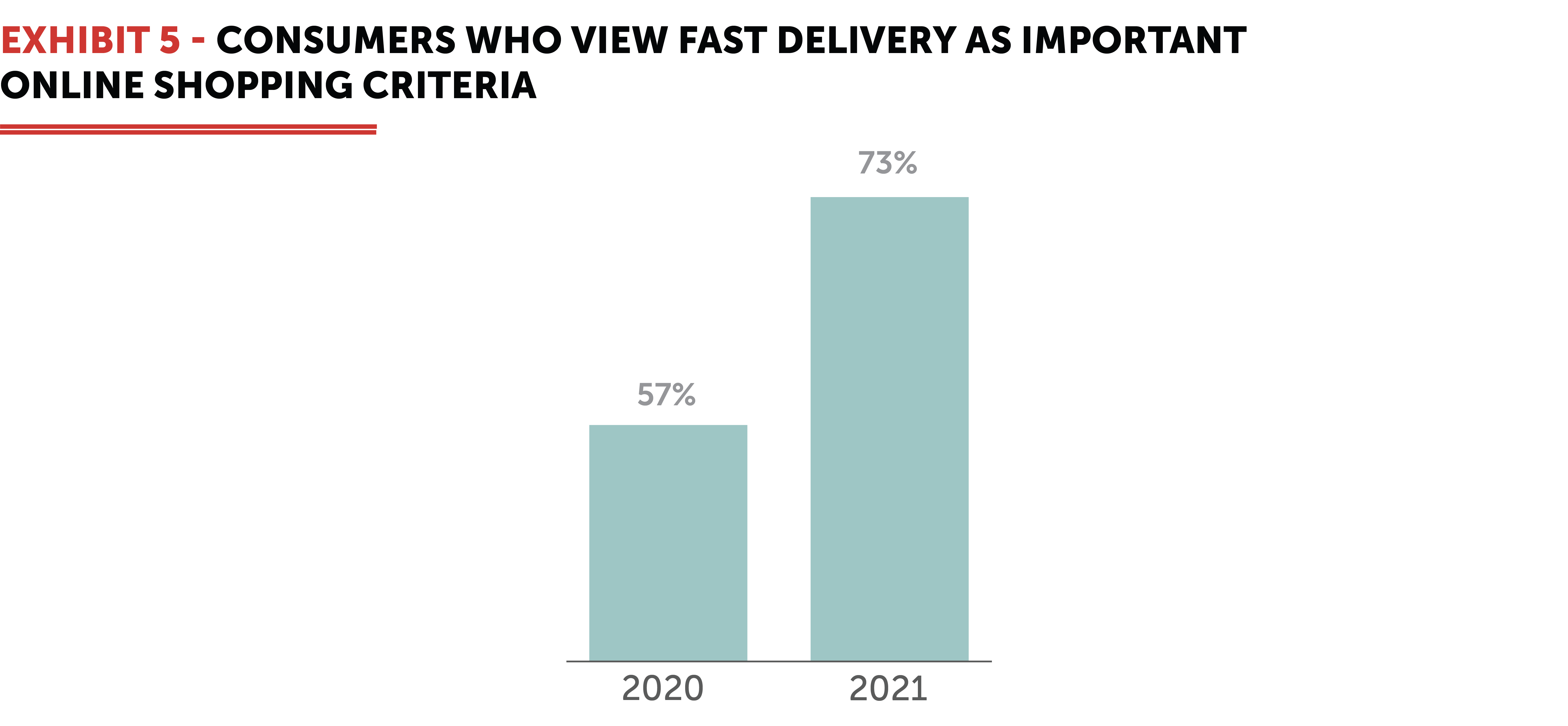

Faster delivery is becoming more and more important to consumers, and retailers that offer faster shipping options are well-positioned to gain an edge over the competition. Exhibit 5 shows that 73% of consumers view fast delivery as critical online shopping criteria, a nearly 22% jump from 2020.

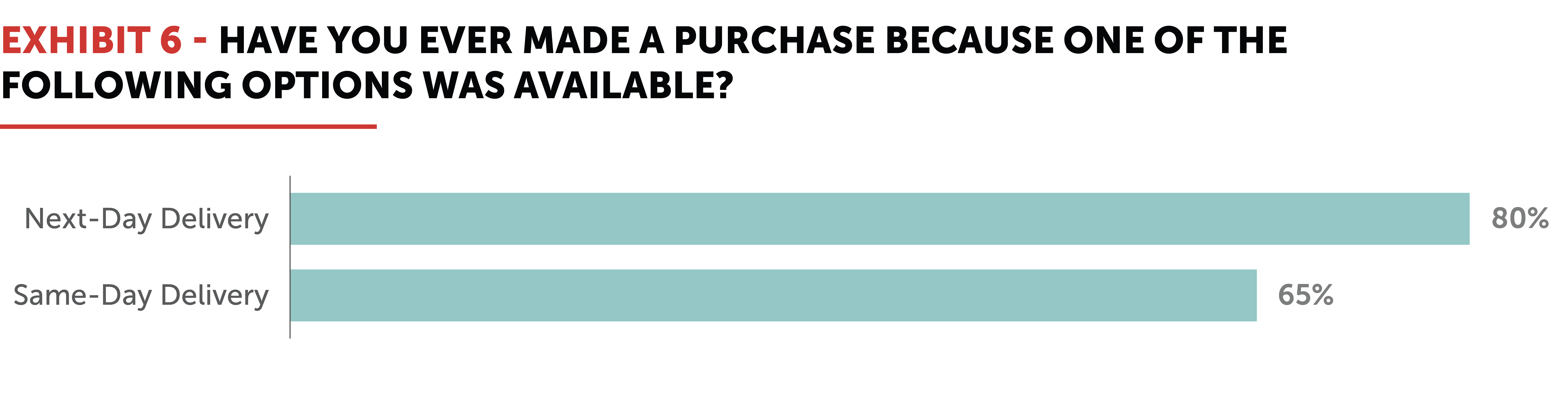

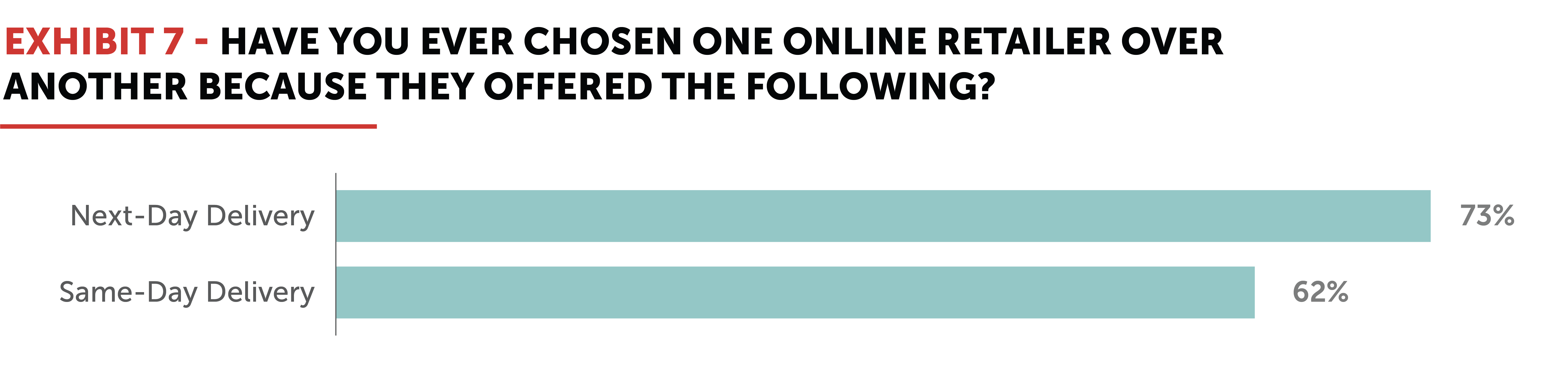

As reflected in Exhibit 6 and Exhibit 7, the availability of next-day and same-day delivery has driven an overwhelming number of consumers to make a purchase or choose one online retailer over another. These findings are particularly compelling and reflect the extent of the pandemic’s impact on shopping behaviors, as 62% of consumers surveyed in June 2020 had never paid for expedited delivery.

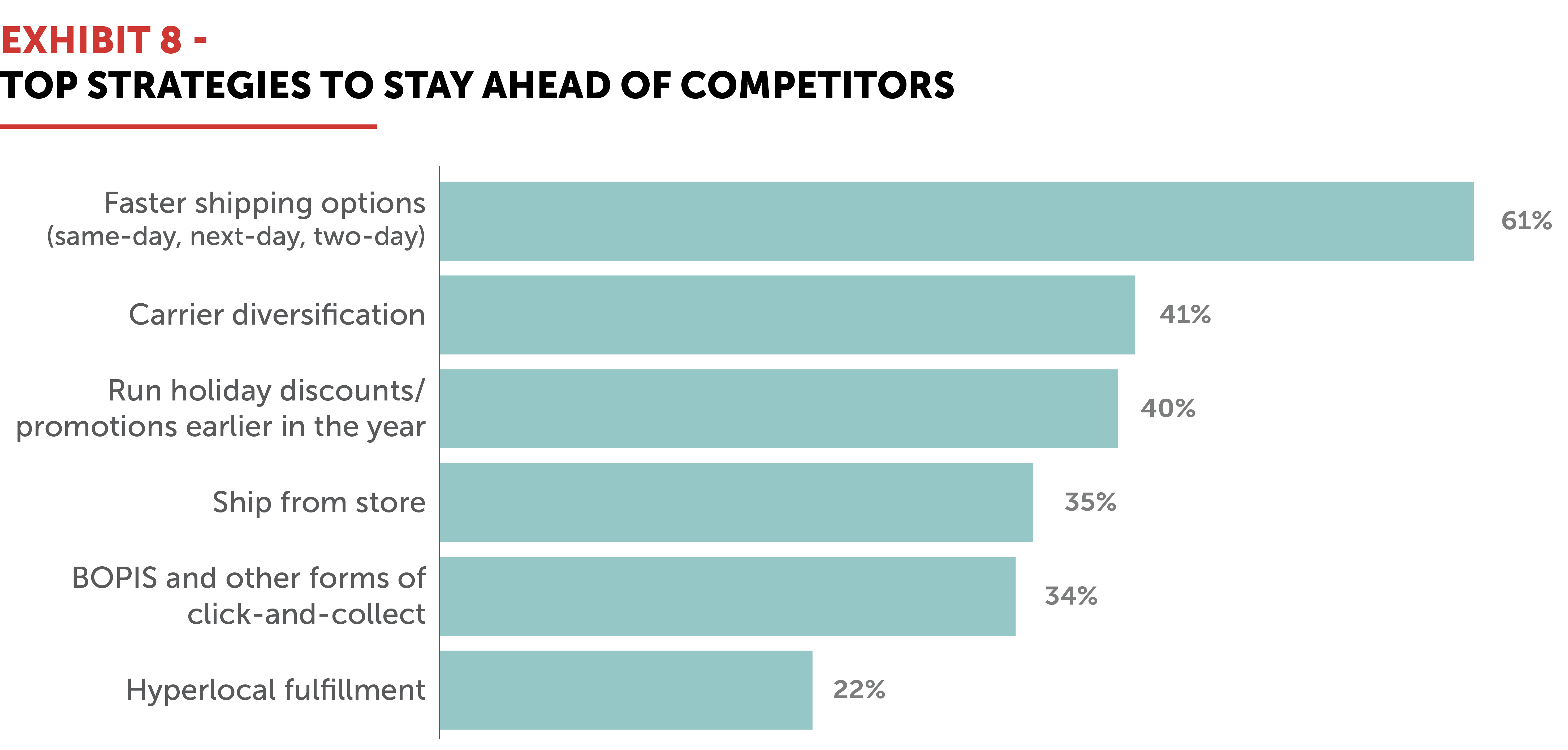

Top online retailers have recognized the value of faster delivery to consumers and are adapting their supply chain strategies accordingly. We asked over 100 C-Suite, VP, and director level supply chain professionals at large retailers who spend at least $50 million on parcel annually about the challenges they are currently facing due to the rapid growth of e-commerce and how they plan to respond. Exhibit 8 shows that 61% of retailers surveyed stated that offering faster shipping options is their primary differentiating strategy to stay ahead of the competition. Retailers who still have slow delivery times are at a disadvantage and are losing customers.

Consumers Are Willing to Pay for Fast Delivery

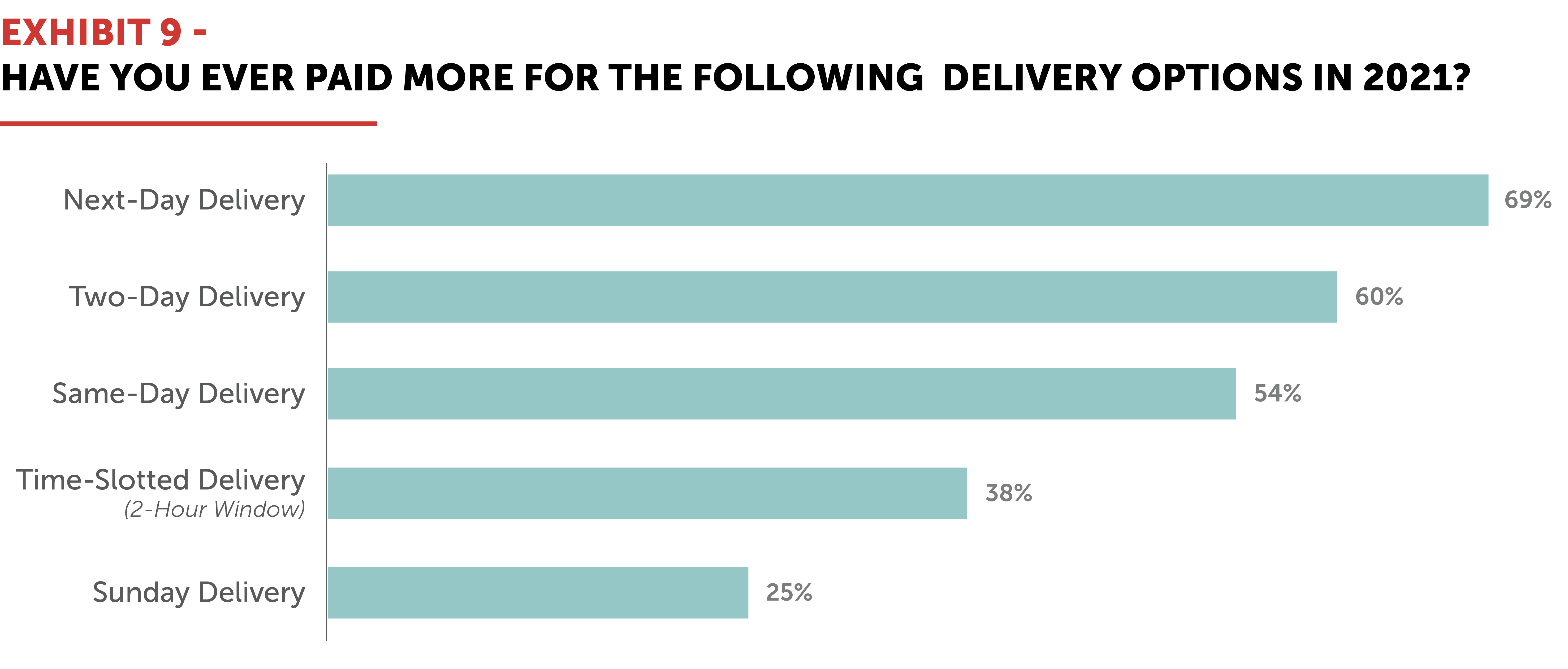

Consumers want their items to arrive faster—even if they have to pay for it. In 2021 alone, nearly 60% of shoppers surveyed paid for faster delivery, with 69% of those having paid more for next-day delivery, as shown in Exhibit 9.

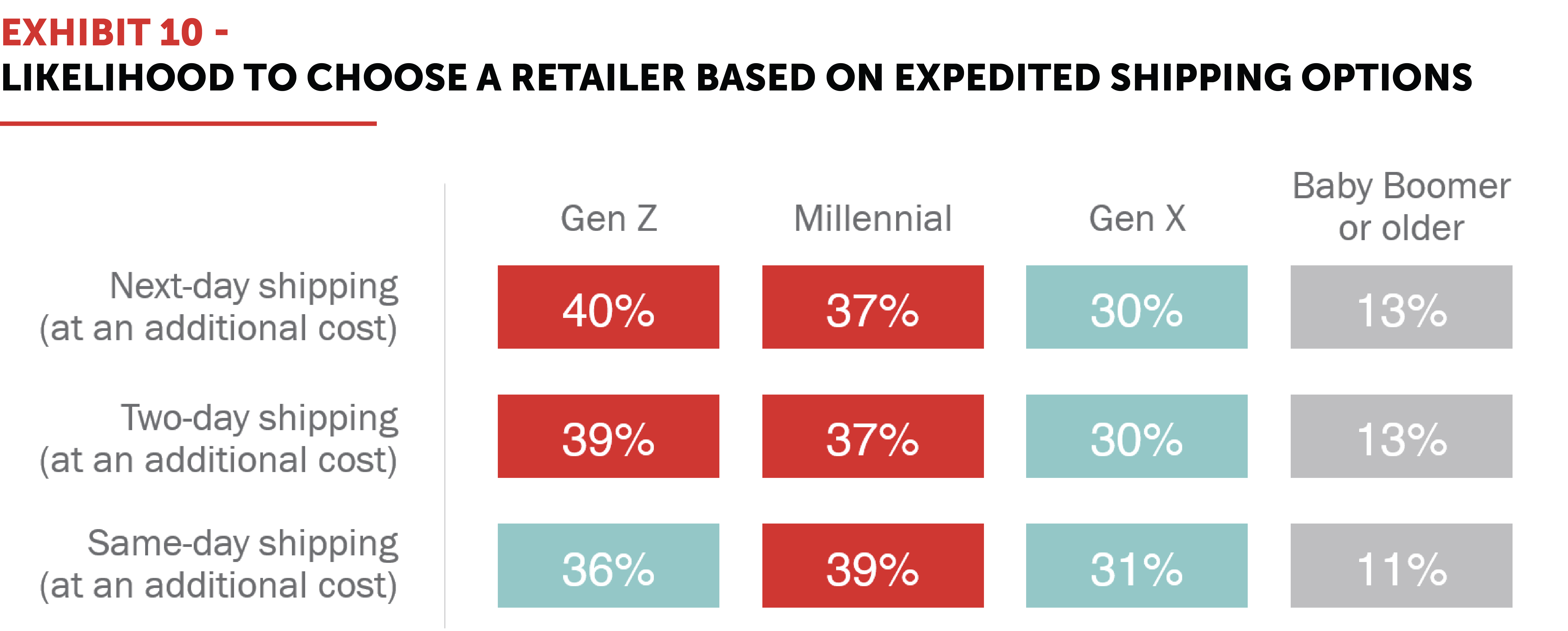

Having grown up in the digital era of instant gratification, younger generations are significantly more likely to pay for faster delivery options. As shown in Exhibit 10, 40% of Gen Z consumers and 37% of Millennials would increase their probability of shopping at a new retailer if they offered next-day delivery at an additional cost. Delivery speed will increasingly drive purchase decisions as younger generations increase their buying power and share of the market. Retailers that can establish relationships with Gen Z consumers and Millennials early on can differentiate themselves and grow lifetime value in the competitive, brand-agnostic economy.

Free Shipping Still Reigns Supreme

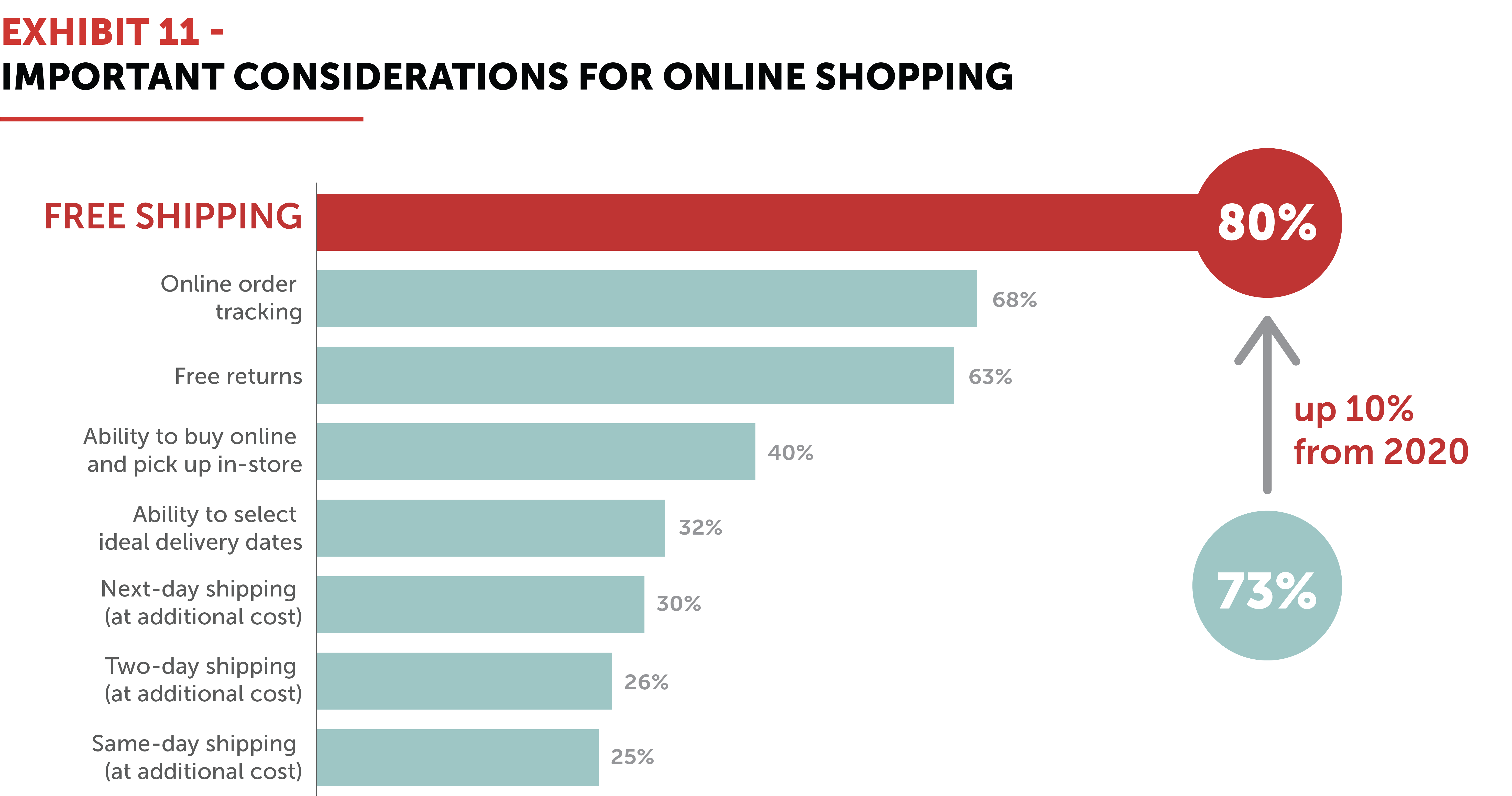

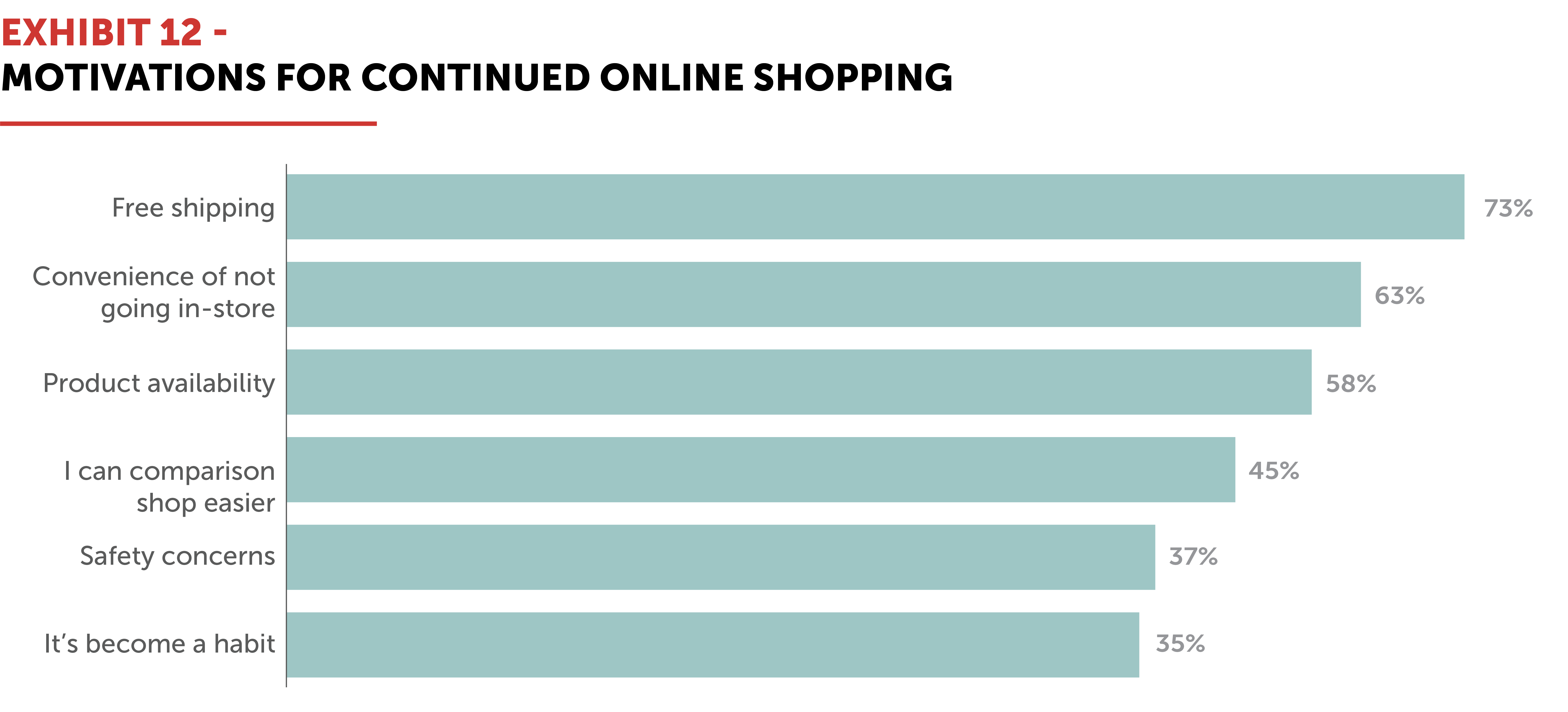

willing to try new retailers and the rapid decline of brand loyalty. The number of consumers that call free shipping the most important consideration when shopping online is increasing. Exhibit 11 shows that 80% of consumers indicated that free shipping is the most critical factor when it comes to online shopping, up 10% compared to 2020. Moreover, free shipping is seen as the most important marker of a positive experience, with 73% of consumers expressing that free shipping is the reason they will continue to shop online long-term, as shown in Exhibit 12.

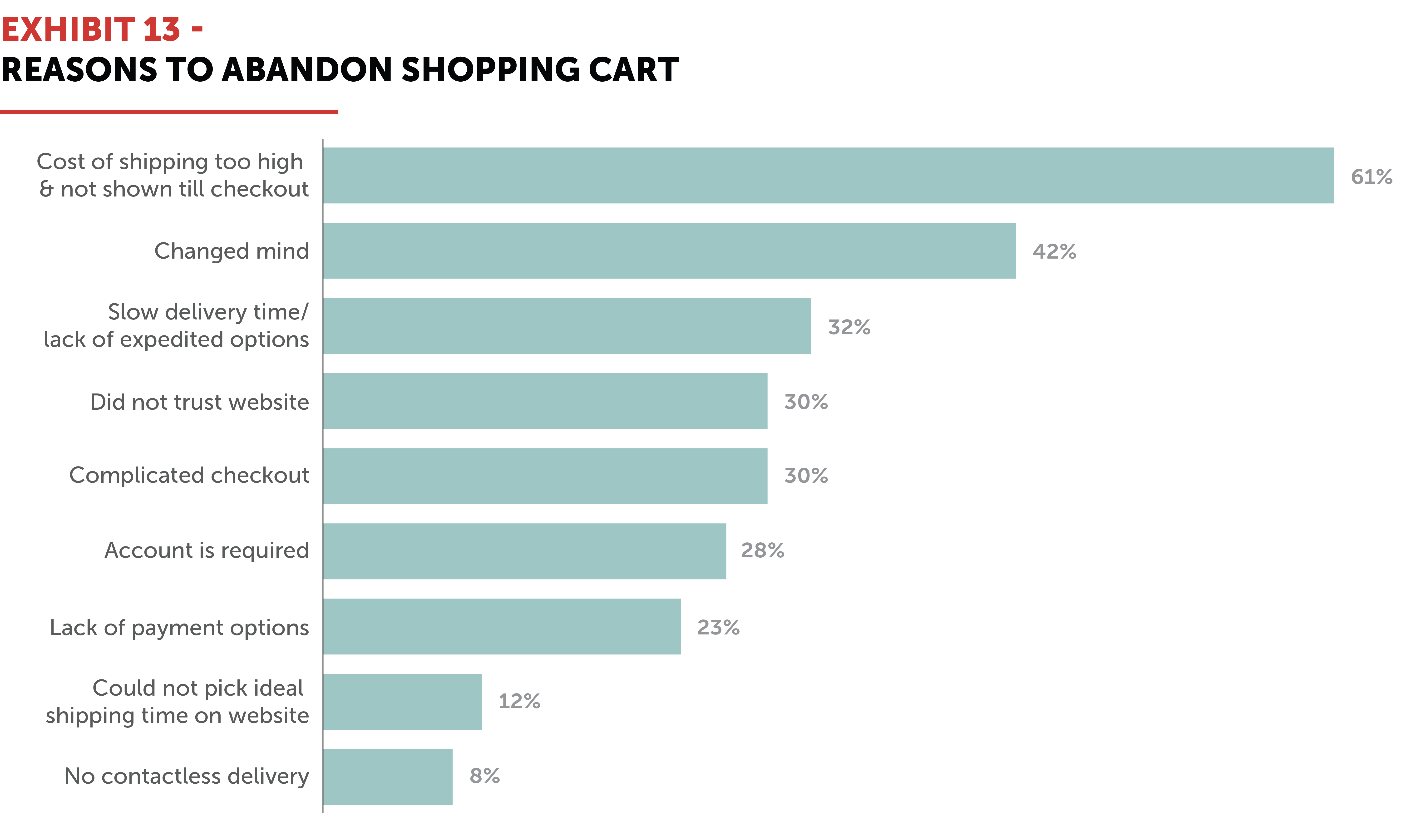

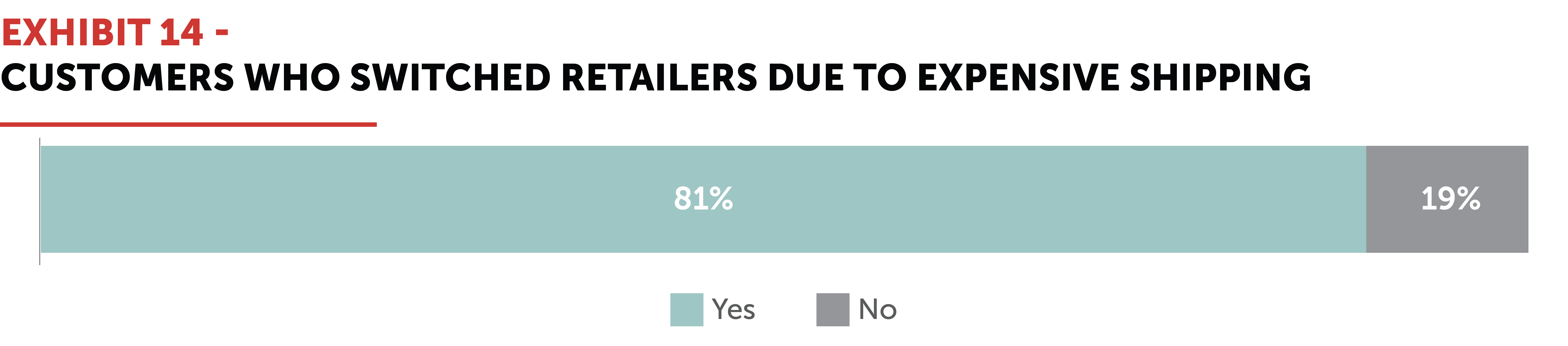

When it comes to free shipping, consumers have made one thing clear: Make free shipping available or they will shop elsewhere. Consumers have explicitly expressed that they want to keep shopping online because of free shipping, but shoppers note that expensive shipping costs (52%) and slow delivery (40%) are getting in the way. High shipping costs are the leading cause of consumers abandoning their carts. In 2021 alone, 81% of consumers switched retailers due to high shipping costs, as reflected in Exhibit 13 and Exhibit 14. Moreover, nearly half (47%) of consumers abandoned their carts because shipping was too expensive.

How Can Retailers Build Flexible, Resilient Supply Chains That Respond to Evolving Consumer Expectations?

-

Build Faster Delivery into Your Supply Chain to Increase Customer Loyalty.

-

Differentiate from Competitors by Offering Fast and Free Home Delivery

-

Add Regional Carriers to Build Flexibility and Ensure Capacity in Your Supply Chain

Build Faster Delivery into Your Supply Chain to Increase Customer Loyalty

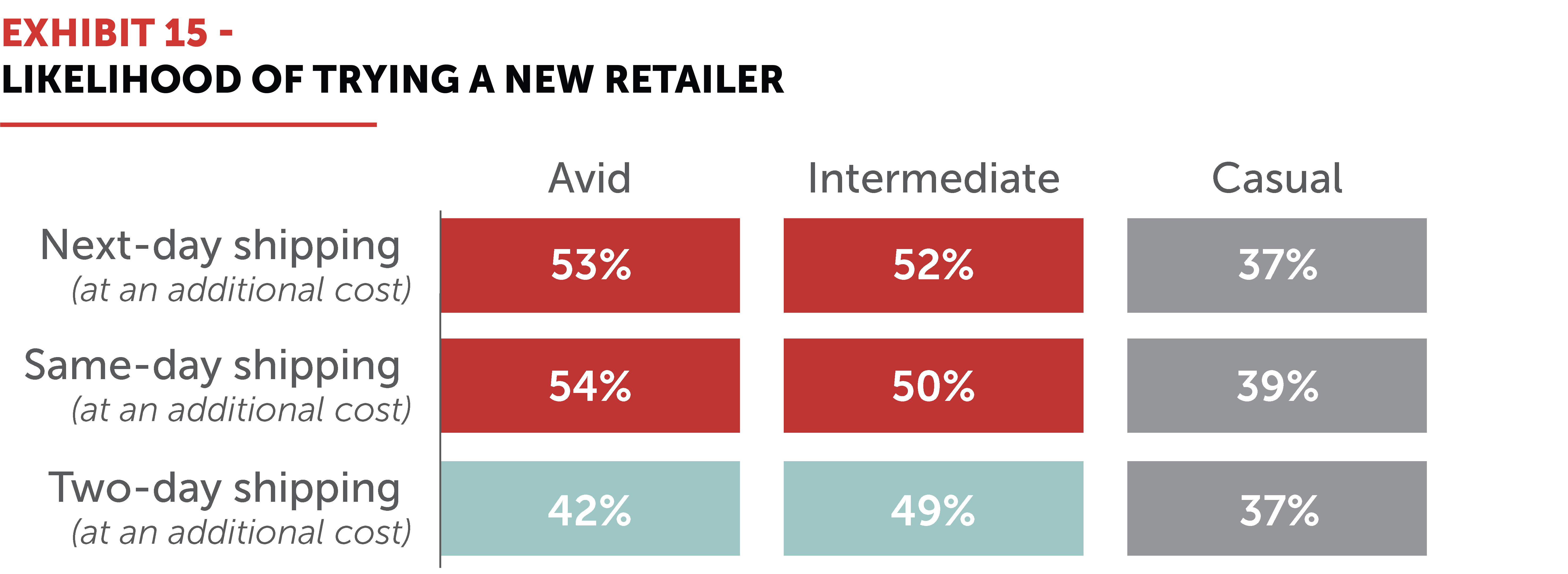

As speed continues to grow in importance to consumers, retailers can leverage faster delivery as a customer acquisition and retention tool. Exhibit 15 shows that over half of consumers would be more likely to try a new retailer that offered next-day and same-day shipping at an extra cost. It also shows that more than half of avid shoppers (6+ purchases per month) and intermediate shoppers (3-5 purchases per month) are willing to pay for faster delivery, empowering retailers with faster delivery built in their supply chains to gain more share of wallet. Additionally, according to a Narvar survey, consumers named faster delivery as the most important feature retailers can offer to retain customers.

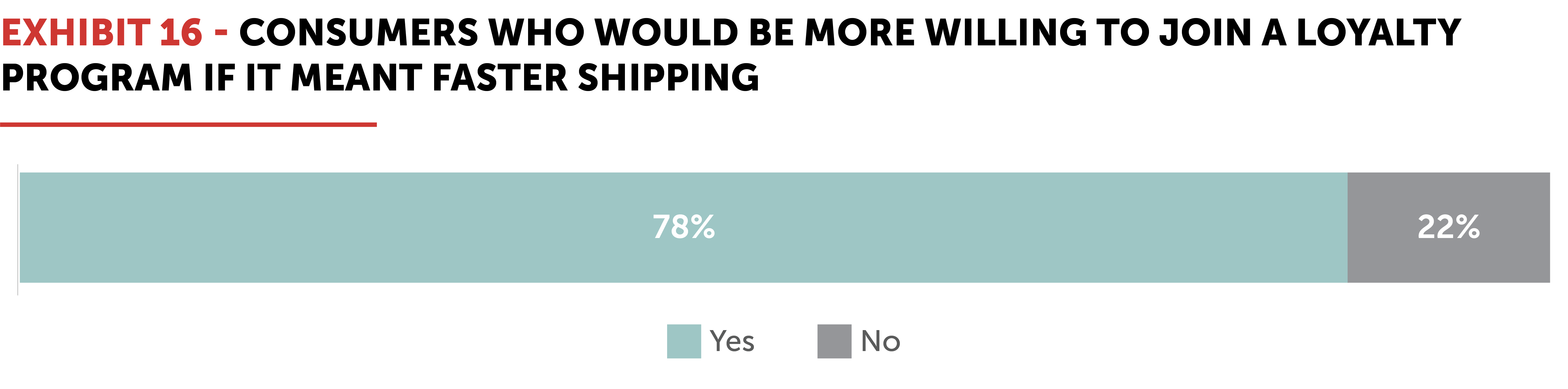

As evidenced by the success of Amazon Prime, fast delivery can build lifetime value. Exhibit 16 shows that 78% of consumers would be willing to sign up for a loyalty program to get faster deliveries.

When COVID-19 called into question just how loyal consumers were to specific brands, retailers looked to the Amazon model and redesigned their loyalty programs to include membership benefits like free and faster shipping. Walmart launched its subscription program, Walmart Plus, to compete with Amazon, which includes same-day shipping on certain items. Gap also updated its membership program to provide free and faster shipping to members that spend over a specific dollar amount each year.

Retailers that can create easy, convenient shopping experiences with faster delivery options can establish lasting relationships with customers and increase lifetime value to take a greater share of the growing market.

Differentiate from Competitors by Offering Fast and Free Home Delivery

With such seemingly straightforward preferences for convenience and speed, where are retailers missing the mark? Retailers can start by addressing the elephant in the room: buy online, pick up in-store (BOPIS) and click and collect. Contrary to their demands for home delivery, consumers’ use of BOPIS and other forms of click and collect has grown exponentially since the start of the pandemic—but this is not because of convenience or preference. In fact, the lack of free and fast delivery options is the driving force behind consumers’ adoption of BOPIS. Fifty-two percent of consumers we surveyed chose to shop in-store instead of online due to slow delivery, while 64% of consumers that participated in a Pew Research survey stated they use BOPIS primarily to avoid paying shipping fees.

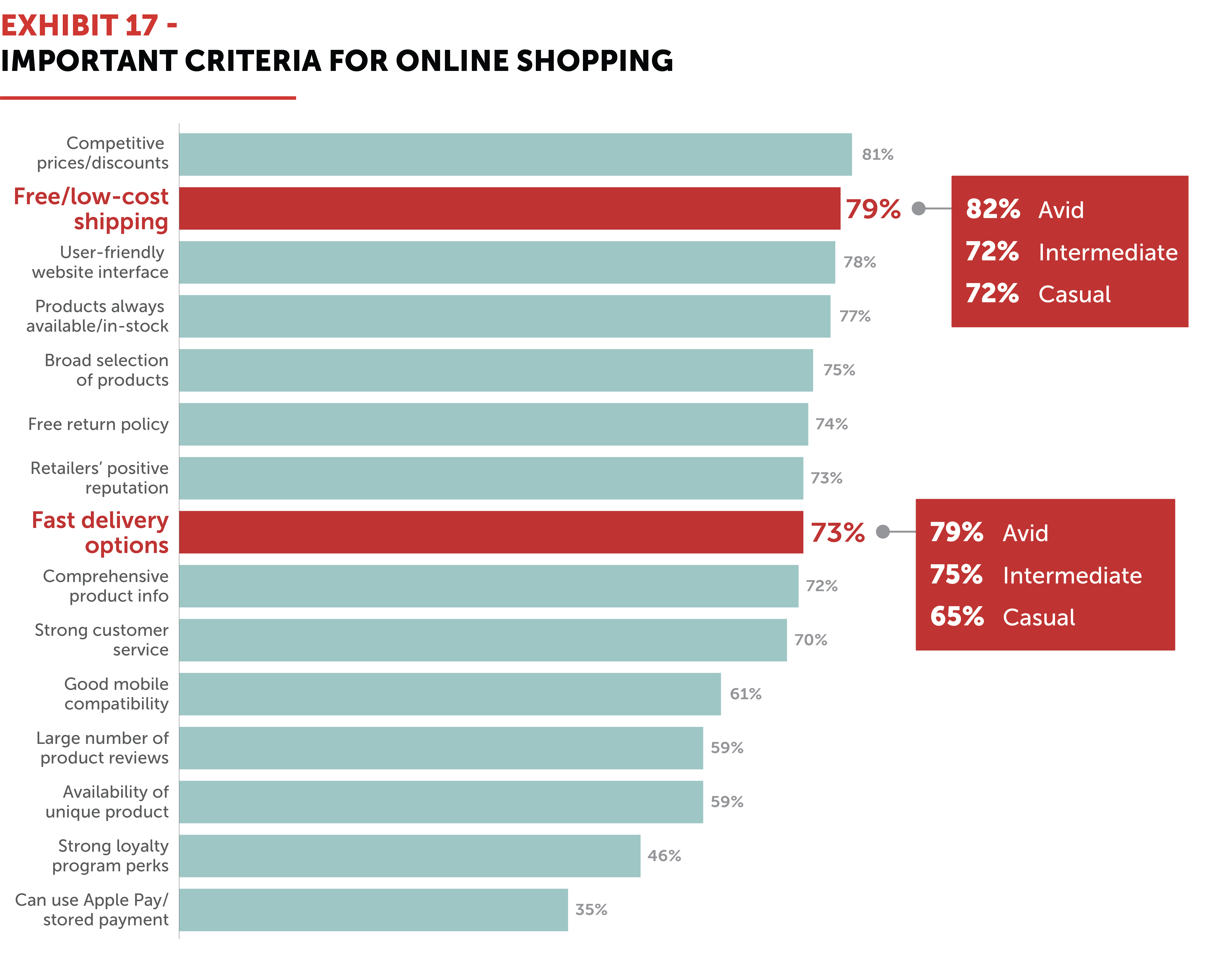

Traditionally considered cost drivers, free shipping and faster delivery should be viewed as value creators and part of a retailer’s customer acquisition strategy. As shown in Exhibit 17, the majority of consumers view free or low-cost shipping and fast delivery as critically important criteria for online shopping. These factors are especially valuable to avid shoppers, who make over six online purchases each month, thus validating that free and fast delivery builds brand loyalty. Despite the majority of consumers expressing the importance of free shipping, only 17.5% of the top 1,000 retailers offer free shipping on all orders. Retailers that bridge the gap by offering free and fast home delivery can acquire customers and build lifetime value in an increasingly competitive and brand-agnostic environment.

Add Regional Carriers to Build Flexibility and Ensure Capacity in Your Supply Chain

National carriers have been implementing capacity constraints and surcharges since the start of the pandemic in 2020—and there is no end in sight. Today, shipping prices are rising faster than they have in a decade. Sixty-five percent of top online retailers we surveyed have experienced an off-schedule price increase in the last 24 months. The rapid shift to e-commerce has also led to an overwhelming capacity crunch, resulting in hundreds of millions of packages being capped annually. Thirty-four percent of retailers surveyed currently have their shipping capacity capped, with two-thirds of those facing caps between 10% and 49% of their total volume.

Retailers need to act now to diversify their carrier mix or risk losing customers and money. With elevated levels of e-commerce here to stay after the pandemic and consumers expecting their items to be delivered faster, single-carrier strategies are now obsolete and put retailers at a disadvantage.

Adding regional carriers to your carrier base can help retailers meet consumer expectations around next-day service and faster delivery times. Regional carriers are proven alternative to national carriers that can help retailers improve their margins with lower costs, enhance the consumer experience with faster delivery options, and increase capacity and flexibility.

Position Your Retail Business for Lasting Success

The future of e-commerce is bright. With so many opportunities on the table, the ability to build a flexibly, resilient supply chain that quickly adapts to evolving expectations will help retailers turn the delivery experience into a competitive advantage. Retailers that diversify their carrier base to increase capacity and flexibility and provide customers with free, faster, more reliable home delivery can achieve sustainable success and keep customers coming back.

About the Author

Josh Dinneen is the Chief Commercial Officer at LaserShip, the leader in last-mile delivery and largest regional e-commerce parcel carrier in the U.S., where he oversees revenue strategy, sales, marketing, account management, and call center operations. Josh has over 18 years of experience in the industry, and prior to his current role, he created LaserShip’s e-commerce hub and spoke delivery network as the Vice President of Supply Chain.

About Hanover Research

Founded in 2003, Hanover Research is a global market research and analytics firm that delivers market intelligence through a unique, fixed-fee model to more than 1,000 clients. Headquartered in Arlington, Virginia, Hanover employs high-caliber market researchers, analysts, and account executives to provide a service that is revolutionary in its combination of flexibility and affordability. Hanover was named a Top 50 Market Research Firm by the American Marketing Association in 2015, 2016, 2017, and 2018, and has also been twice named a Washington Business Journal Fastest Growing Company. To learn more about Hanover Research, visit https://www.hanoverresearch.com.

Definitions

Generation Z / Young millennial: 18-35 years old

Millennial: 26-34

Generation X: 35-54

Baby Boomers and older: 55+

Methodology

The findings in this report are based on a survey commissioned by LaserShip and conducted by Hanover Research of 3,000 U.S. online shoppers about shipping and delivery experiences before, during, and after the pandemic. The survey included responses from Generation Z, Millennials, Generation X, and Baby Boomers and older. Percentages may not add up to 100% due to rounding. Some respondents chose not to answer certain demographic questions.

References

- https://www.weforum.org/agenda/2020/08/covid19-pandemic-social-shift-ecommerce-report/

- https://swnsdigital.com/us/2021/08/americans-plan-on-using-home-deliveries-as-their-primary-form-of-shopping-even-post-pandemic/

- https://www.getconvey.com/blog-d-fast-free-shipping-amazon-delivery-expectations/

- https://see.narvar.com/rs/249-TEC-877/images/State-of-Returns-New-Expectations-Narvar-Consumer-Study-2020.pdf

- https://www.parcelpending.com/blog/reducing-shipping-costs-a-win-win-for-consumers-and-retailers/

- https://www.digitalcommerce360.com/2019/08/28/only-17-5-of-online-retailers-offer-free-shipping/

- https://www.wsj.com/articles/fedex-ups-rate-rises-are-making-online-shopping-more-expensive-11632173409

- https://www.dcvelocity.com/articles/51028-the-new-parcel-reality-record-volumes-tight-capacity-higher-costs-inconsistent-service