2020 presented retailers with a unique set of challenges. While online sales increased dramatically due to the pandemic, supply chains were tested. Retailers had to respond in real time to new consumer behaviors and the shifting landscape in how consumers shop.

The 2020 holiday shopping season was unlike any other, in large part due to an increase in consumer spending long before the traditional Thanksgiving start.

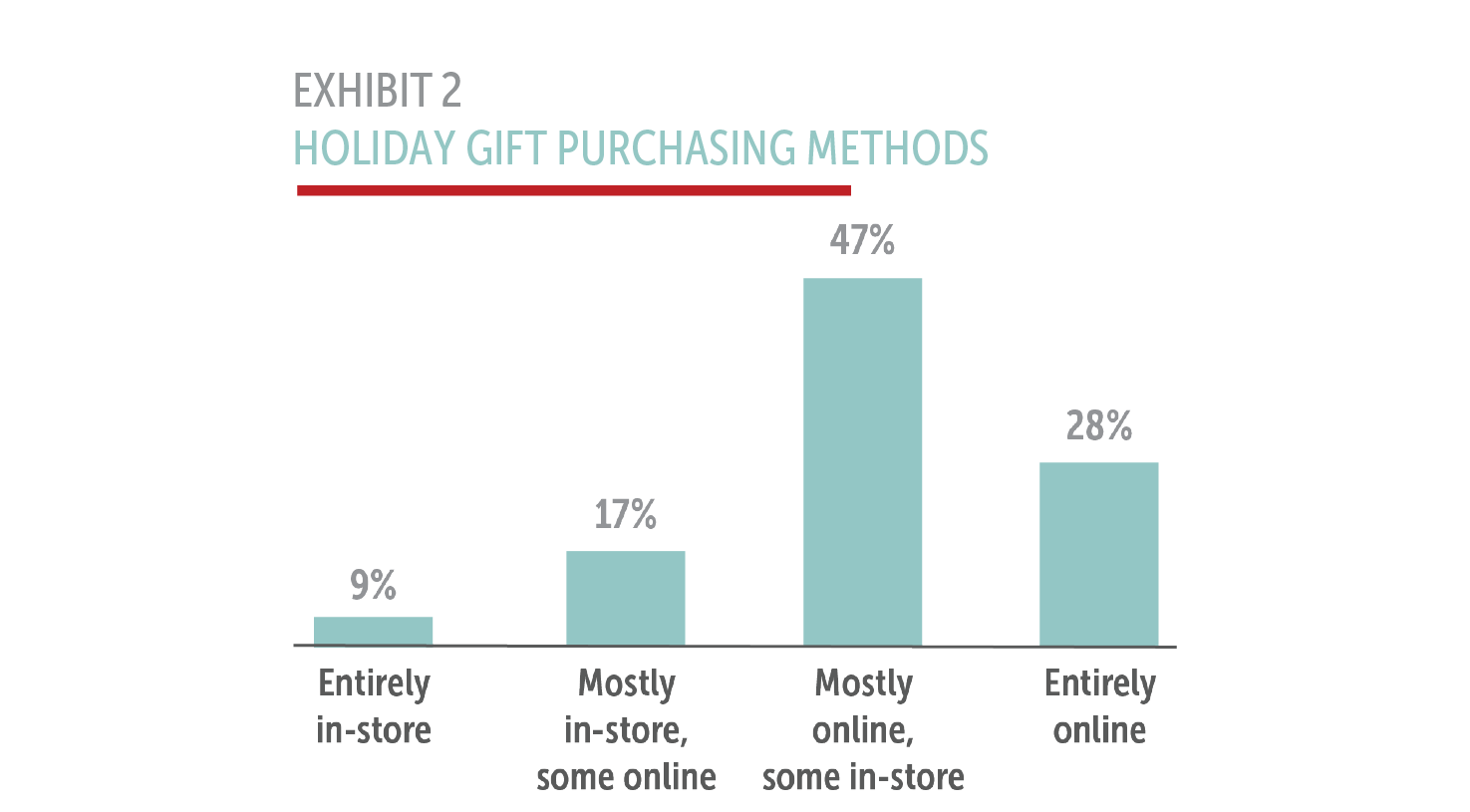

Exhibit 1 shows consumers spent $1,090 on holiday shopping in 2020 vs $1,047 in 2019–just a 4% increase. While spend levels remained relatively flat, consumers shopped more online due to health and safety concerns with the pandemic. 28% of consumers shopped for holiday gifts entirely online, and 75% of consumers shopped primarily online. Furthermore, 37% of consumers that lived in urban areas indicated they are more likely to shop entirely online when compared to consumers living in suburban and rural areas (28%).

To further understand shopping behaviors and consumer expectations both during the 2020 holiday shopping seasons and post-pandemic, LaserShip commissioned a study from Hanover Research to survey over 1,000 online shoppers in the U.S. The results indicate that holiday shopping started earlier, free shipping is the most important factor when deciding to shop at a retailer, faster delivery is a differentiator for retailers, and that consumers plan to keep shopping online after receiving a COVID-19 vaccine.

Key Takeaways

Holiday Shopping is Starting Earlier and is Shifting Online

Consumers are starting their holiday shopping earlier and have shifted their spending online.

Free Shipping has Become the Most Important Factor when Choosing a Retailer

No longer a “nice to have”, free shipping has become table stakes for retailers looking to acquire new customers.

Faster Delivery is a Differentiator

In today’s retail environment, delivery speed has become a differentiating feature to help retailers stand out in an increasingly competitive marketplace.

Online Spend Levels are Here to Stay Post-Pandemic

When the pandemic is over and restrictions lift, consumers will spend the same, or more, on online shopping than before the pandemic.

Holiday Shopping Started Earlier

51% of consumers surveyed indicated they started their holiday shipping earlier in 2020 when compared to 2019. As shown in Exhibit 3, 40% of consumers completed the majority of their holiday shopping from Prime Day, on October 13th and 14th, to Thanksgiving, and 32% after Cyber Monday. While Prime Day may return to its traditional 2-day event in July, consumers clearly responded to retailers that started holiday promotions earlier.

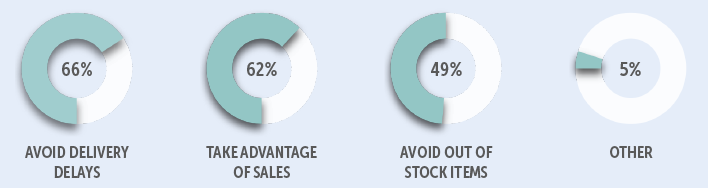

Why Did Consumers Start Their Holiday Shopping Early?

66% indicated avoiding delivery delays as the most important factor, followed by sales/promotions (62%) and avoiding out of stock items (49%). The conversion to online shopping from in-store, a secular shift over the past decade, was accelerated by the pandemic. Furthermore, a busy holiday shopping season left consumers clearly concerned about avoiding delivery delays and receiving their items on-time and without incident. Many large retailers and brands encouraged consumers to start their holiday shopping earlier to find in-stock items and added regional carriers to mitigate shipping delays they were already experiencing from FedEx, UPS, and the USPS.

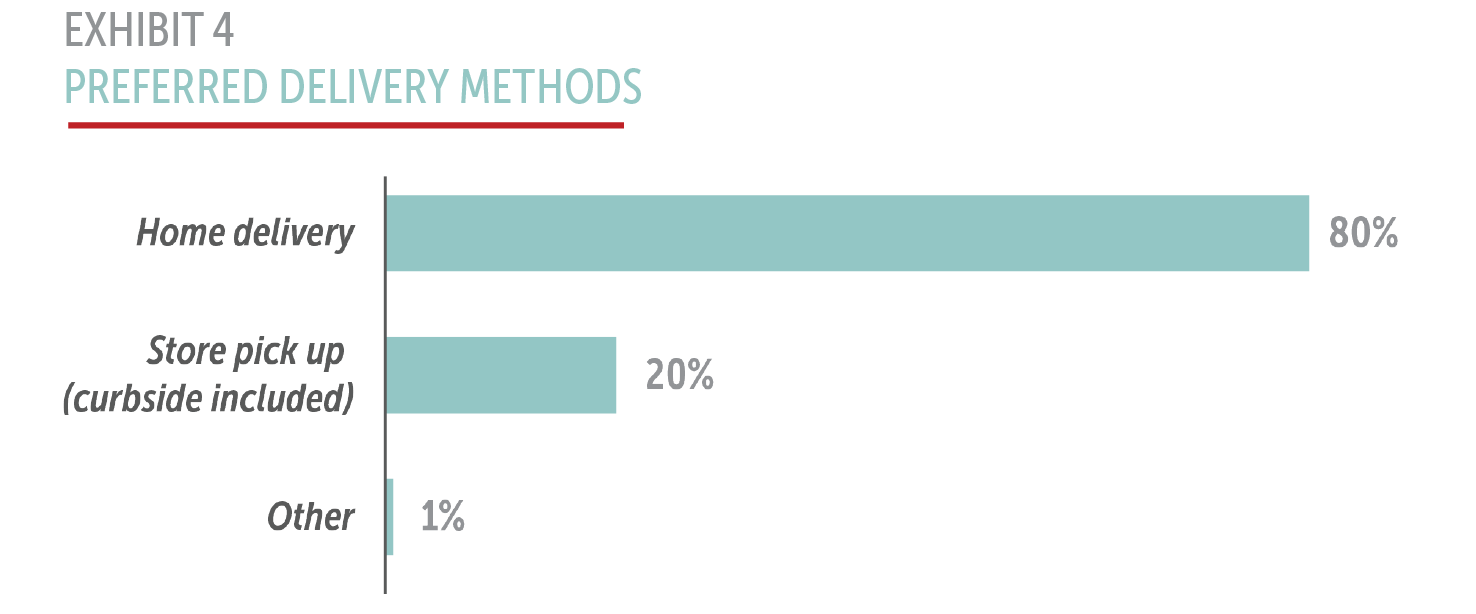

Exhibit 4 shows that consumers overwhelmingly preferred to receive items through home delivery when compared to in store pickup, including curbside, buy online pick-up in store (BOPIS), and other forms of click and collect. Click and collect presents challenges for retailers including lack of product availability, inaccurate inventory levels reflected online, and long wait times at pick up.

Click and collect is driven by retailers looking to manage rising logistics and last mile delivery costs. While BOPIS and other forms of click and collect have emerged as alternatives to offset shipping fees, the data shows consumers still overwhelmingly prefer home delivery and are relying on fast, reliable delivery options more than ever as they make most of their purchases online.

Customers Choose Retailers Who Offer Free Shipping

60% of consumers surveyed stated free shipping is the most influential factor when choosing to shop at a retailer during the holiday season, ahead of sales/discounts (58%) and a seamless shopping experience (37%).

Since many consumers were not able to visit with family and friends during the holidays in 2020, free shipping became even more important. Walmart announced in December 2020 that it’s new Walmart Plus membership program would no longer require shoppers to meet the $35 minimum purchase requirements to qualify for free shipping.

Rather than sticking to familiar shopping behaviors and brands, 46% of US consumers have switched brands or retailers according to a McKinsey study1. Free shipping has emerged as a customer acquisition tool now more than ever as online shopping continues to grow and brand loyalty has declined. A great opportunity has emerged for retailers to win new customers for the long term, and free shipping is one of the most important factors.

FASTER DELIVERY IS A DIFFERENTIATOR AND CONSUMERS WILL PAY FOR IT

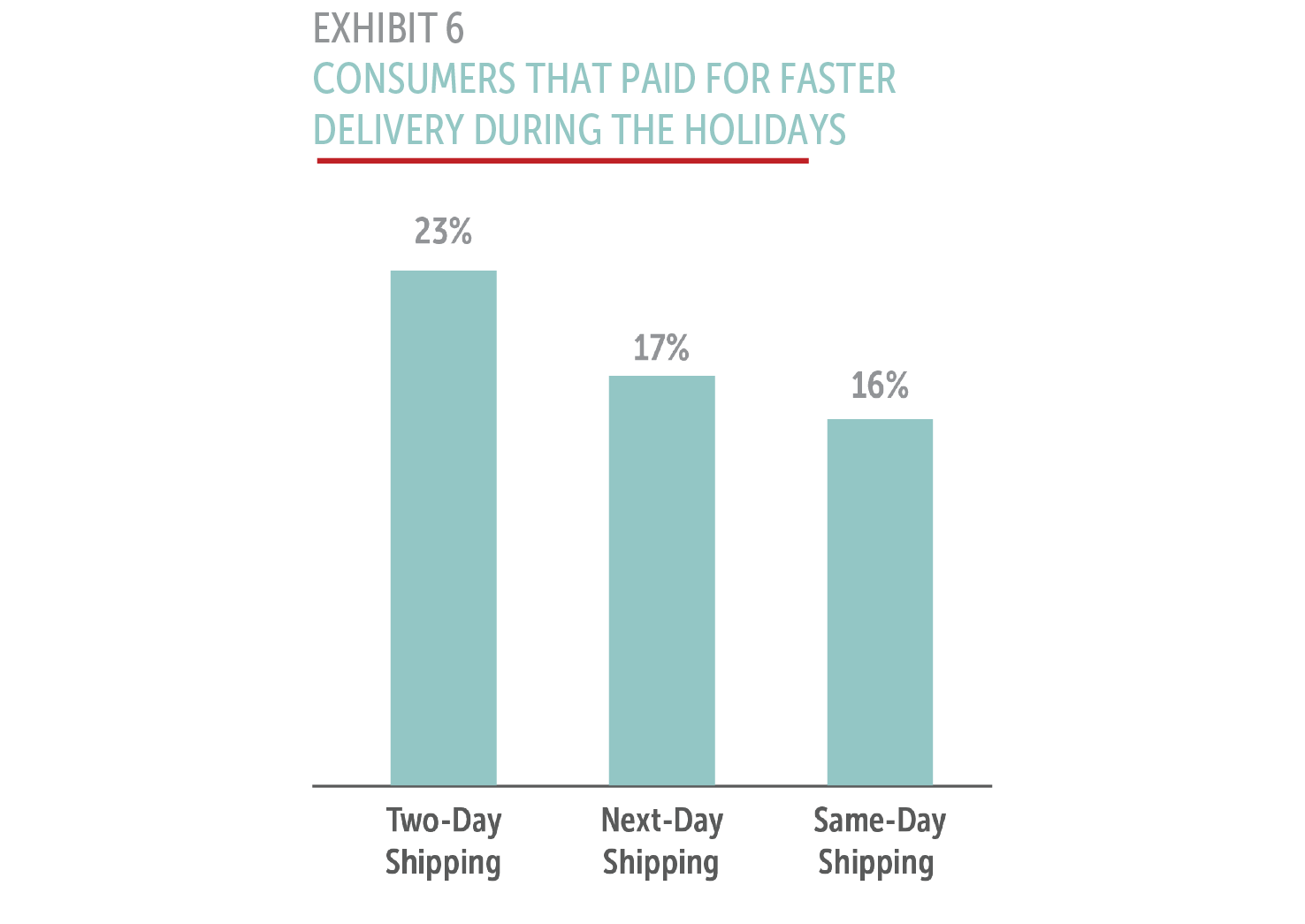

56% of consumers surveyed paid for some form of expedited shipping during the holiday shopping season. 23% paid for two-day shipping, 17% next-day shipping, and 16% for same-day. As consumers try new retailers during the pandemic, retailers can leverage faster shipping to retain these newly acquired customers. According to a Narvar survey, faster shipping is the most important factor when surveyed by consumers on how retailers can retain customers.2

Gen Z and Millennials are significantly more likely to pay extra for expedited shipping than Gen X and Baby Boomers. Having grown up in the instant economy where food, transportation, dating, and just about anything imaginable can be accessed and purchased online in just a tap, this is no surprise. However, Gen Z accounts for 40% of all consumers with increasing buying power. Retailers that can establish relationships with these consumers early on can differentiate themselves and grow lifetime value in an increasingly competitive, brand agnostic economy. Moreover, 63% of consumers indicated faster delivery options would influence signing up for a loyalty program as they recognize the benefit of faster delivery.3

Online Spend Levels are Here to Stay

Consumers spent over $861 billion online, a 44% increase compared to 2019. The pandemic accelerated ecommerce penetration as a percentage of total retail sales to 21.3% in 2020, and accounted for all growth in retail sales.4

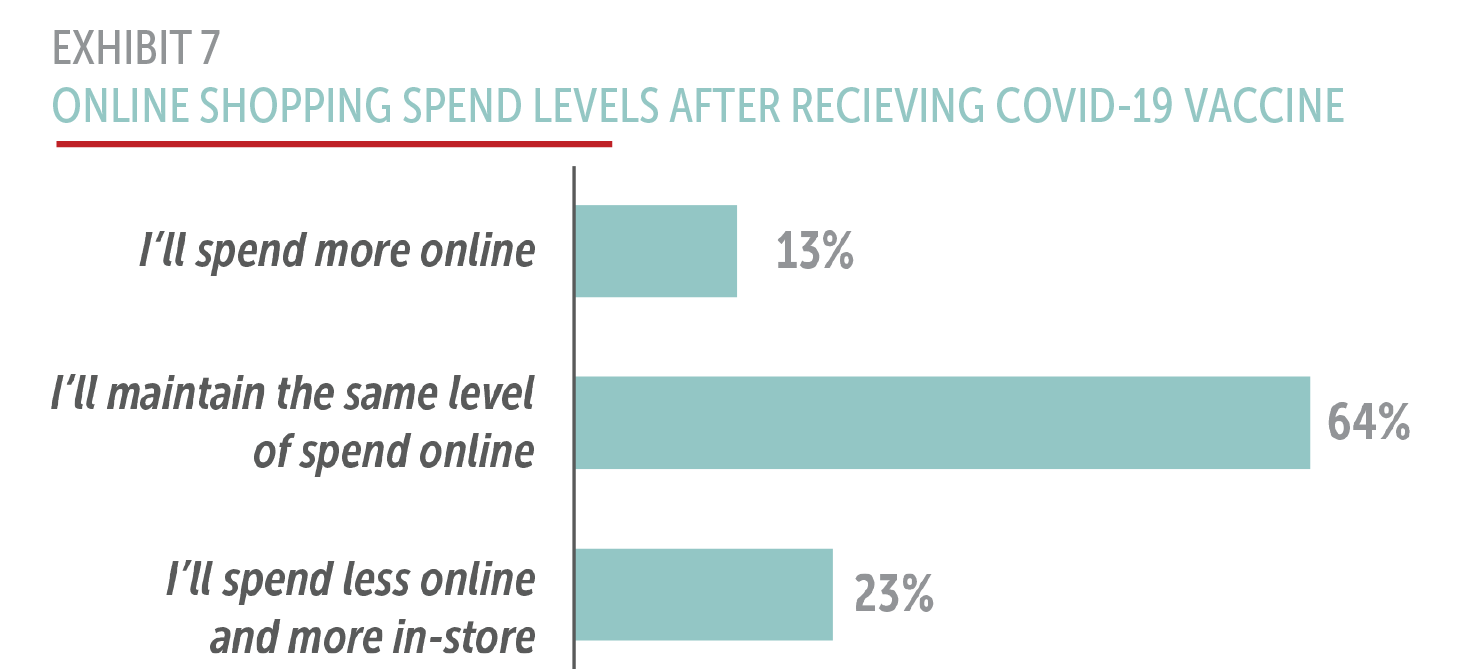

According to survey respondents, 71% of consumers plan to get one of the COVID-19 vaccines in 2021. Even after getting the vaccine, Exhibit 7 shows that 64% of consumers plan to maintain the same level of online spend and 13% plan to spend more online despite being able to return to brick and mortar retailers, substantiating the acceleration of the secular shift to ecommerce as a percentage of retail.

The increase in spending is widespread across retail categories. According to a McKinsey & Company COVID-19 U.S. Consumer Pulse Survey, consumers plan to increase their purchases online post COVID-19 by 20-40% across retail categories, with groceries, apparel, fitness & wellness, and child products driving the most growth.5

Consumers’ preferences clearly show they have been embracing ecommerce and plan to continue to spend at the same levels, if not more, once the pandemic ends. The benefits of ecommerce, including the time saved and convenience of having your items delivered to your doorstep, have become a permanent way of shopping. Retailers who have made digital investments are reaping the benefits and gaining market share, as free shipping has become critical for customer acquisition.

Exhibit 8 shows that of the consumers who plan to maintain the same level of spend or more, 64% indicated free shipping as the primary factor, followed by convenience (59%), safety concerns (45%) and product availability (44%).

What Can Retailers Do to be Successful in 2021 and Beyond

With consumers clearly indicating their preferences to continue to shop online after the pandemic along with their expectations of free and fast shipping, how can retailers respond?

Start Holiday Promotions Earlier

An early start to the holiday shopping season is a win-win for both consumers and retailers. Consumers can take advantage of promotions and discounts and have more options to shop in-stock inventory. According to a survey conducted by the National Retail Federation, 52% of shoppers took advantage of early holiday sales and promotions in 2020.6

Retailers can benefit by starting sales and promotions earlier in November or even October. Without the traditional Thanksgiving kickoff to the holiday seasons usually accompanied by door busting, in-store shopping experiences, many retailers including BestBuy and Walmart announced holiday sales in October, creating an extended holiday shopping experience with multiple opportunities to communicate with consumers. The results were positive, as holiday retail sales grew by 8.3% according to the National Retail Federation. Retailers also benefit by leveling out demand for in-demand products over time. In a crowded marketplace, retailers that show out-of-stock items for in-demand products will lose sales as potential buyers go elsewhere. Leveling out demand also has logistics and shipping benefits, as retailers can mitigate the capacity constraints and risk in holiday deliveries while also potentially avoiding peak season surcharges.

Retailers Need to Get it There Faster

Free shipping is a must-have to acquire new customers online, especially with consumers willing to try new retailers and the rapid decline of brand loyalty.

Amazon Prime set consumer expectations with standard two-day, one-day, and same-day delivery. In 2020, 76% of consumers said fast shipping speed is a top characteristic of a positive experience with an online brand or retailer, an increase of 14% compared to 2019.7 The data clearly shows that consumers are willing to pay for faster delivery, especially younger generations who have grown up in the instant gratification economy and whose purchasing power will only increase. Retailers need to leverage free shipping to acquire these customers and build loyalty and lifetime value through faster delivery.

Lower Logistics Costs by Building Flexibility Within Your Supply Chain

Consumers are telling retailers they demand free shipping and faster delivery. Yet, with the growth in online sales, retailers are having to manage rising logistics and last mile delivery costs. According to a Commerce Next survey, 63% of retailers surveyed cited consumers’ expectations of fast, free delivery coupled with shipper surcharges as their top concern during the 2020 holiday shopping season. When asked about logistics concerns in the same survey, retailers responded that the top two concerns were shippers capping deliveries during peak demand (60%) and shipper surcharges straining profitability (59%).9 In addition to holiday surcharges, FedEx announced a new surcharge on shippers with a weekly average volume of at least 30,000 that will add an additional 30 cents per Express and Ground Residential Package. Furthermore, FedEx stated that surcharges will be a part of their pricing strategy moving forward for e-commerce. UPS also announced it will re-instate its pre-holiday peak surcharge rates on Ground Residential packages for shippers with volumes over 25,000 weekly packages. UPS also placed shipping limits on some of its largest retail customers during the 2020 holiday shopping seasons to minimize capacity constraints in its network.8

Retailers are getting squeezed on both sides. How do they meet consumer expectations with the growth in e-commerce while also managing higher delivery costs and volume constraints implemented by carriers?

Build flexibility and optionality within your supply chain by diversifying your carrier mix. With elevated levels of ecommerce here to stay after the pandemic and consumers expecting their items to be delivered faster, single-carrier shipping strategies are unlikely to be able to support retailers’ growth strategies moving forward. They are obsolete. Retailers can improve their margins with lower costs, enhance the customer experience with faster delivery options, and increase capacity by adding regional carriers to their carrier mix.

Retailers faced unique challenges unlike any other year in 2020. Those retailers that invested in digital channels benefited from tremendous growth in e-commerce, offsetting the loss of revenue from in-store sales. The holiday shopping season channel shift to e-commerce is here to stay as the majority of consumers shifted their spending online. Retailers had to balance the increase in online sales against rising logistics and last mile delivery costs with surcharges, rate increases, and volume caps.

However, challenges present unique opportunities. Retailers that can offer free and faster shipping while building flexibility within their supply chains will acquire and retain new customers and create sustainable competitive advantage long after the pandemic ends.

About the Author

Josh Dinneen is the Chief Commercial Officer at LaserShip, the leader in last-mile delivery and largest regional ecommerce parcel carrier in the US, where he oversees revenue strategy, sales, marketing, account management,and call center operations. Josh has over 18 years of experience in the industry, and prior to his current role, he created LaserShip’s e-commerce hub and spoke delivery network as the Vice President of Supply Chain.

About Hanover Research

Founded in 2003, Hanover Research is a global market research and analytics firm that delivers market intelligence through a unique, fixed-fee model to more than 1,000 clients. Headquartered in Arlington, Virginia, Hanover employs high-caliber market researchers, analysts, and account executives to provide a service that is revolutionary in its combination of flexibility and affordability. Hanover was named a Top 50 Market Research Firm by the American Marketing Association in 2015, 2016, 2017, and 2018, and has also been twice named a Washington Business Journal Fastest Growing Company. To learn more about Hanover Research, visit https://www.hanoverresearch.com.

Definitions

Generation Z / Young millennial: 18-35 years old

Millennial: 26-34

Generation X: 35-54

Baby Boomers and older: 55+

Methodology

The findings in this report are based on a survey commissioned by LaserShip and conducted by Hanover Research of 1,000 U.S. online shoppers about shipping and delivery experiences before, during, and after the pandemic. The survey included responses from Generation Z (10%), Millennials (19%), Generation X (37%), and Baby Boomers and older (24%). Percentages may not add up to 100% due to rounding. Some respondents chose not to answer certain demographic questions.

References

- https://www.mckinsey.com/business-functions/marketing-and-sales/solutions/periscope/our-insights/surveys/reinventing-retail

- https://see.narvar.com/rs/249-TEC-877/images/State-of-Returns-New-Expectations-Narvar-Consumer-Study-2020.pdf

- https://cdncom.cfigroup.com/wp-content/uploads/CFI-Radial-Report-Dec-2019.pdf

- https://www.digitalcommerce360.com/article/us-ecommerce-sales/

- https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/survey-us-consumer-sentiment-during-the-coronavirus-crisis

- https://nrf.com/media-center/press-releases/holiday-shoppers-take-advantage-early-thanksgiving-weekend-deals

- https://1bnznaaikg11oqsn3tvx88r9-wpengine.netdna-ssl.com/wp-content/uploads/2019/09/WalkerSands_Future_of_B2B_Retail_2019_WSRB_FINAL.pdf

- https://www.wsj.com/articles/ups-slaps-shipping-limits-on-gap-nike-to-manage-e-commerce-surge-11606926669